Today, the Shareholders’ Meeting of Arnoldo Mondadori Editore S.p.A., chaired by Marina Berlusconi, approved the financial statements for the year ended 31 December 2018 and reviewed the 2018 consolidated financial statements of the Mondadori Group. Adjusted net profit from continuing operations amounted to € 20.3 million as forecast.

As a result of the fair value adjustment of the French assets (€ -200.1 million) subject to disposal, the net loss at 31.12.2018 was € -177.1 million versus € 30.4 million in 2017. The Shareholders’ Meeting resolved to fully cover this loss by using a corresponding amount of reserves, in accordance with the proposal made by the Board of Directors.

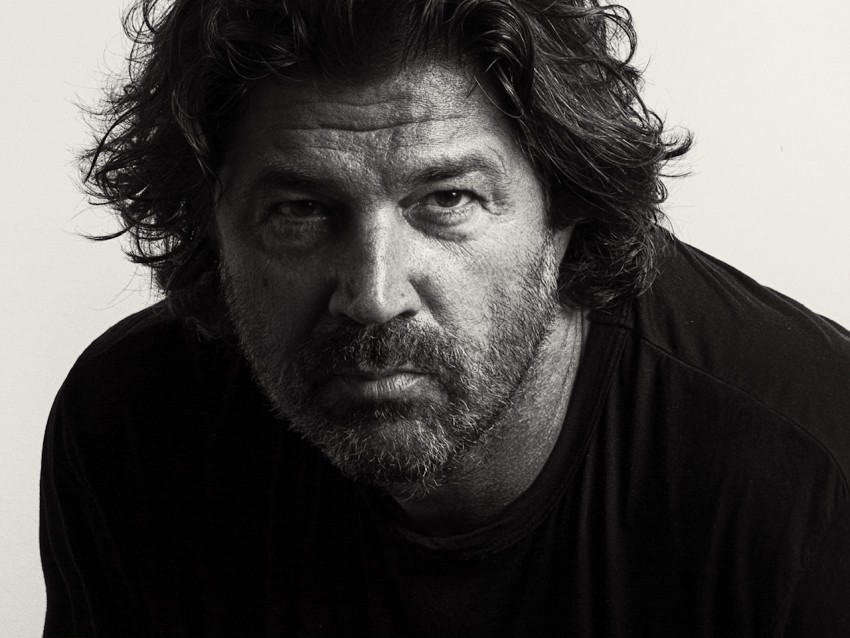

In his report, CEO Ernesto Mauri presented the key figures on the performance of the Mondadori Group in 2018, as disclosed to the market last 14 March 2019.

Moreover, the Shareholders’ Meeting resolved, in ordinary session, on the following items on the agenda:

REMUNERATION REPORT

The Shareholders’ Meeting approved Section One of the Remuneration Report on the policy adopted for 2019 regarding remuneration to directors and key management personnel.

RENEWAL OF THE AUTHORIZATION TO PURCHASE AND SELL TREASURY SHARES

Given the approaching expiry of the previous authorization resolved on 24 April 2018, the Meeting renewed the authorization to purchase treasury shares up to a cap of 10% of its share capital. The Meeting also authorized to sell the treasury shares acquired by the Company in compliance with art. 2357-ter of the Italian Civil Code.

To date, Arnoldo Mondadori Editore S.p.A. holds a total of no. 1,346,703 treasury shares, equal to 0.515% of the share capital.

Here below is the information provided, also with regard to the provisions of art. 132 of Legislative Decree 58/1998 and to the provisions of art. 144-bis of Issuer Regulation no. 11971/1999, on the authorization issued by the Shareholders’ Meeting.

Motivations

The motivations underlying the authorization granted to purchase and sell treasury shares refer to the opportunity to attribute to the Board of Directors the power to:

- to use the treasury shares purchased as compensation for the acquisition of interests within the framework of the Company’s investments;

- to use the treasury shares purchased against the exercise of option rights, including conversion rights, deriving from financial instruments issued by the Company, its subsidiaries or third parties and to use the treasury shares for lending, exchange or transfer transactions or to support extraordinary transactions on the Company’s capital or financing transactions that imply the transfer or sale of treasury shares;

- to undertake any investments, directly or through intermediaries, including for the purpose of containing abnormal movements in share prices, stabilizing share trading and prices, supporting the liquidity of the share on the market, in order to foster the regular conduct of trading beyond normal fluctuations related to market performance, without prejudice in any case to compliance with applicable statutory provisions;

- to possibly rely on investment or divestment opportunities, if considered strategic by the Company, also in relation to available liquidity;

- to sell treasury shares as part of share-based incentive plans pursuant to art. 114-bis of Legislative Decree 58/1998, and of plans for the free allocation of shares to Shareholders.

Duration

The authorization to purchase treasury shares is set to last until the approval of the financial statements for the year ending 31 December 2019, while the authorization to sell is granted to last for an unlimited period.

Maximum number of purchasable treasury shares

The authorization refers to the purchase, including in more than one tranche, of a maximum number of ordinary shares with a nominal value of € 0.26 each, also taking into account the shares held directly or indirectly in the portfolio from time to time, up to a cap of 10% of the Company’s share capital.

Criteria for purchasing treasury shares and indication of the minimum and maximum purchasing cap

Purchases shall be made on regulated markets pursuant to the combined provisions of art. 132 of Legislative Decree no. 58/1998, of art. 5 of Regulation (EU) 596/2014, (ii) of art. 144-bis of the Issuer Regulation, (iii) of the EU and national legislation on market abuse, and (iv) of Accepted Market Practices.

Specifically, purchases shall be made on regulated markets, according to operating criteria which do not allow the direct combination of the purchase negotiation proposals with pre-determined sale negotiation proposals.

The minimum and maximum purchase price would be determined under the same conditions established by the preceding Shareholders’ Meeting authorizations, i.e. at a minimum unit price not lower than the official Stock Exchange price of the day preceding the purchase transaction, reduced by 20%, and a maximum not higher than the official Stock Exchange price of the day preceding the purchase transaction, increased by 10%.

In terms of daily prices and volumes, the purchase transactions would be completed in compliance with the conditions established in art. 3 of the Delegated Regulation (EU) 2016/1052.

Purchases instrumental in (a) the support to market liquidity and (b) the purchase of treasury shares to build a so-called “treasury shares” portfolio, shall also be made in accordance with the conditions provided by market practices, under the combined provisions of art. 180, par. 1, lett. c) of Legislative Decree 58/1998 and of art. 13 of (EU) Regulation 596/2014.

With regard to the sale of treasury shares, the Meeting resolved to authorize the Board of Directors to sell purchased treasury shares: (i) through disposal of the shares on regulated markets; (ii) as consideration in the acquisition of interests as part of the Company’s investment policy; (iii) in the exercise of option rights, including conversion rights, deriving from financial instruments issued by the Company or third parties; (iv) to service share-based incentive plans approved by the Shareholders’ Meeting without any time limits.

2019-2021 PERFORMANCE SHARE PLAN

The Shareholders’ Meeting convened today approved, pursuant to art. 114-bis of Legislative Decree 58/1998, the establishment of a Performance Share Plan for the three-year period 2019-2021 intended for the Chief Executive Officer, the CFO – Executive Director and certain managers of the Company, in accordance with the conditions previously disclosed to the market on 14 March 2019, pursuant to art. 84-bis, paragraph 1 of Issuer Regulation 11971/1999.

For details on the 2019-2021 Performance Share Plan, the beneficiaries and the main characteristics of the Regulations of the Plan, reference should be made to the Information Document drawn up by the governing body, pursuant to CONSOB Regulation no. 11971/1999, and to the Explanatory Report, published on the Company’s website www.gruppomondadori.it “Governance/Shareholders’ Meeting” section.

APPOINTMENT OF THE INDEPENDENT AUDITORS

Following expiry of the assignment to Deloitte & Touche S.p.A. on approval of the 2018 financial statements, the Shareholders’ Meeting has tasked Ernst & Young S.p.A. with the statutory audit for the years 2019-2027, approving the relating fee.

In its extraordinary session, the Shareholders’ Meeting also resolved on the:

REVOCATION AND GRANTING OF POWERS TO THE BOARD OF DIRECTORS

In its extraordinary session, the Shareholders’ Meeting adopted, in accordance with the proposals of the Board of Directors, the resolutions referred to in articles 2443 and 2420-ter of the Italian Civil Code, relating to the granting of powers to the Board of Directors to increase the share capital and issue convertible bonds.

Specifically, the Shareholders’ Meeting resolved on:

- the revocation, solely regarding the unexercised portion, of all the powers to increase the share capital and issue convertible bonds granted to the Board of Directors by the Extraordinary Shareholders’ Meeting held on 30 April 2014;

- the granting of powers to the Board of Directors, pursuant to art. 2443 of the Italian Civil Code, to make a divisible increase in the share capital against payment, on one or more occasions, reserved with pre-emptive rights to the assignees, within a period of five years from the resolution date for a maximum nominal amount of € 75,000,000;

- the granting of powers to the Board of Directors, pursuant to art. 2420-ter of the Italian Civil Code, to issue, on one or more occasions, bonds convertible into shares, for a maximum nominal amount of € 250,000,000, including, pursuant to art. 2420-ter, par. 1, of the Italian Civil Code, the powers to correspondingly increase the share capital to service the conversion by issuing ordinary shares with the same characteristics as outstanding shares, for a maximum nominal amount of € 250,000,000, within a period of five years from the resolution date;

- the granting of powers to the Board of Directors, in accordance with art. 2443 of the Italian Civil Code, to make a divisible increase in the share capital against payment, on one or more occasions, within a period of five years from the resolution date, excluding pre-emptive rights in accordance with art. 2441, par. 4, second sentence, of the Italian Civil Code, by issuing ordinary shares up to 10% of the total amount of shares forming the share capital of Arnoldo Mondadori Editore at the date of any exercise of the powers and, in any case, for a nominal amount of up to € 20,000,000.

The resolved renewal and granting of powers is motivated by the expediency to maintain and grant the Board of Directors the general powers to implement, through faster and more streamlined procedures than the resolutions adopted by the Extraordinary Shareholders’ Meeting, any capital transactions to strengthen the financial structure in support of the Group’s development targets.

With particular regard to the powers that may be exercised for capital increases with the exclusion of pre-emptive rights up to a ceiling of 10% of the existing capital, mention should be made that the offer made to third parties may represent an effective tool to increase the free float and maintain appropriate liquidity of the share at any moment, or be functional to the participation of qualified investors in the share capital, while curbing the diluting effects for existing shareholders.

NON-REPLENISHMENT OF REVALUATION RESERVES

The Extraordinary Shareholders’ Meeting also resolved not to replenish the revaluation reserves pursuant to Law no. 72 of 19 March 1983 and Law no. 413 of 30 December 1991, used, according to the resolution of today’s Ordinary Shareholders’ Meeting, to cover the losses recognized in the Company’s financial statements at 31 December 2018, with their resulting elimination, with no obligation to replenish them.

The minutes of today’s Shareholders’ Meeting will be made available in the manner and within the time limits of law.